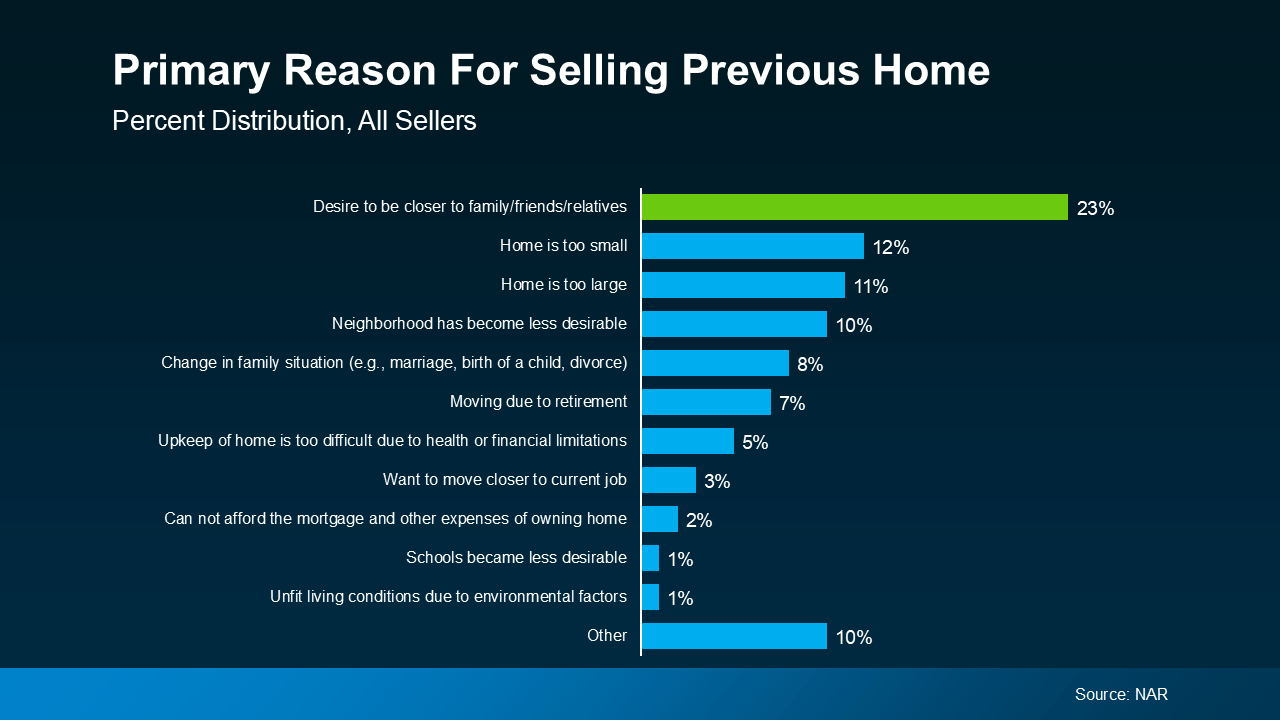

The colder months and important winter holidays often mean more time spent visting with family and friends. Have you ever thought about packing up and moving to be closer to the people who mean the most to you? Maybe you’re tired of long drives to see your family or wish your kids could spend more time with their grandparents. Clearly, a lot of other people feel the same way.

According to recent data from the National Association of Realtors (NAR), the desire to be near family and friends is the #1 reason people move (see graph below):

That’s because moving isn’t just about finding a new house – it’s about living a life where you’re surrounded by the people who matter most. Whether it’s catching up over weeknight dinners, watching your kids play with their cousins, or just knowing someone’s there when you need them, living near loved ones changes everything.

That’s because moving isn’t just about finding a new house – it’s about living a life where you’re surrounded by the people who matter most. Whether it’s catching up over weeknight dinners, watching your kids play with their cousins, or just knowing someone’s there when you need them, living near loved ones changes everything.

Let’s dive into why so many people are making this move and how it could be the best decision for you, too.

Why Family Comes First

Living near family and friends is a universal motivator that cuts across all types of buyers, whether you’re buying your first home or making a big lifestyle change.

But it’s especially important to repeat buyers. Unlike first-time homebuyers, who may be more focused on looking in more affordable areas, repeat buyers often have more flexibility on where they live. Many Baby Boomers, for example, have built significant equity in their homes, giving them the freedom to prioritize what matters most – like retiring near their grandkids. As Ali Wolf, Chief Economist at Zonda, says:

“25% of Baby Boomer households plan to retire near their children and grandchildren . . .”

Making a move to be closer to friends and family is all about creating a meaningful next chapter in your life where loved ones are just around the corner.

The Benefits of Living Near Loved Ones

But moving closer isn’t just a lifestyle choice – it’s a decision that offers real benefits:

- Spending More Time Together Whether it’s joining family dinners, going to weekend activities, or simply having someone nearby to talk to, these moments strengthen relationships and make life more fulfilling.

- Sharing Resources Living close to family can provide practical advantages, too – like sharing childcare, tools, or household items.

- Cutting Down on Travel Instead of spending hours on the road to spend time together, you can enjoy more spontaneous visits. This not only enhances your quality of life, but it also provides peace of mind in case of emergencies.

- Being There for Big Moments It also offers both emotional and practical support during life’s milestones. From graduations to tough times, being close to loved ones helps you feel connected and cared for.

Ready To Make Your Move?

At the end of the day, home isn’t just a place you live – it’s where your people are. Whether you’re looking to spend more quality time with family or enjoy the practical benefits of being closer to loved ones, the decision to move closer to those you care about is a deeply personal one.

Bottom Line

If you’re thinking about making a change, let’s connect. Together, we can explore neighborhoods that bring you closer to the people and places you love most.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link